Renters Insurance in and around Hutchinson

Welcome, home & apartment renters of Hutchinson!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

There’s No Place Like Home

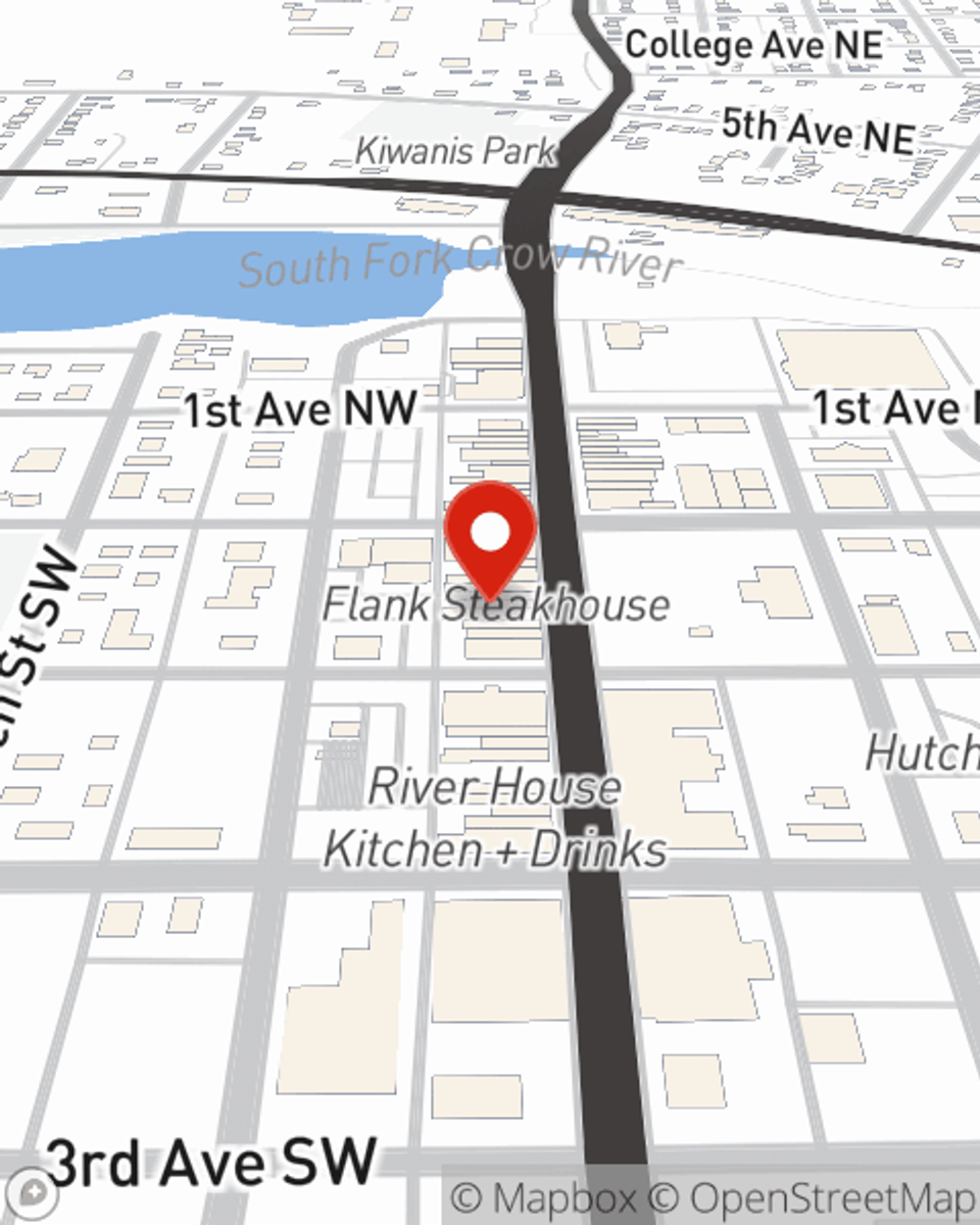

There are plenty of choices for renters insurance in Hutchinson. Sorting through coverage options and savings options to pick the right one isn’t easy. But if you want reasonably priced renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy unbelievable value and hassle-free service by working with State Farm Agent Mike McGraw. That’s because Mike McGraw can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including sound equipment, souvenirs, appliances, linens, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Mike McGraw can be there to help whenever mishaps occur, to get you back in your routine. State Farm provides you with insurance protection and is here to help!

Welcome, home & apartment renters of Hutchinson!

Renting a home? Insure what you own.

Why Renters In Hutchinson Choose State Farm

Renters insurance may seem like the least of your concerns, and you're wondering if it can actually help you. But pause for a minute to think about the cost of replacing all the personal property in your rented condo. State Farm's Renters insurance can help when abrupt water damage from a ruptured pipe damage your belongings.

If you're looking for a reliable provider that can help you understand your options, reach out to State Farm agent Mike McGraw today.

Have More Questions About Renters Insurance?

Call Mike at (320) 587-2565 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Mike McGraw

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.